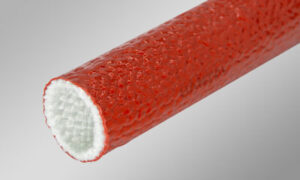

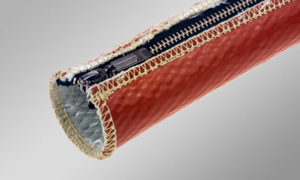

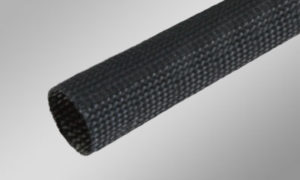

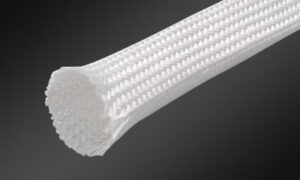

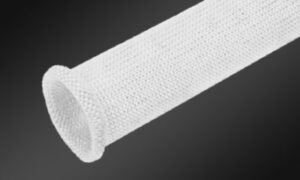

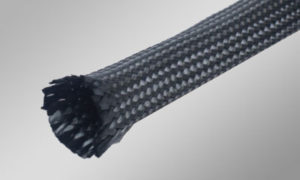

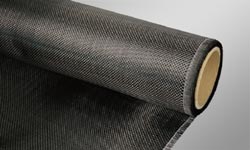

The fire sleeve manufacturer, Hantai, provides you with more information about fiberglass products!

One, fiberglass products are renowned for their excellent performance and versatility.

Fiberglass products have emerged as essential raw materials in various sectors such as construction, transportation, electronics, electrical engineering, chemistry, metallurgy, sports, environmental protection, and military defense. Approximately 70% to 75% of these products are used in the preparation of reinforced thermosetting and thermoplastic plastics, which find widespread application in industrial equipment and building materials (such as glass-reinforced plastic cooling towers, pressure pipes, water tanks, storage tanks, and corrosion-resistant structures). These materials are extensively used in the petrochemical industry, infrastructure development, and the automotive industry. The remaining 25% to 30% of fiberglass products are utilized in the manufacturing of printed circuit boards, wind turbine blades, and filter nets, with significant applications in the electronics, electrical, environmental protection, and renewable energy sectors.

Two, the international glass fiber industry is influenced by economic cycles and waves of rising prices.

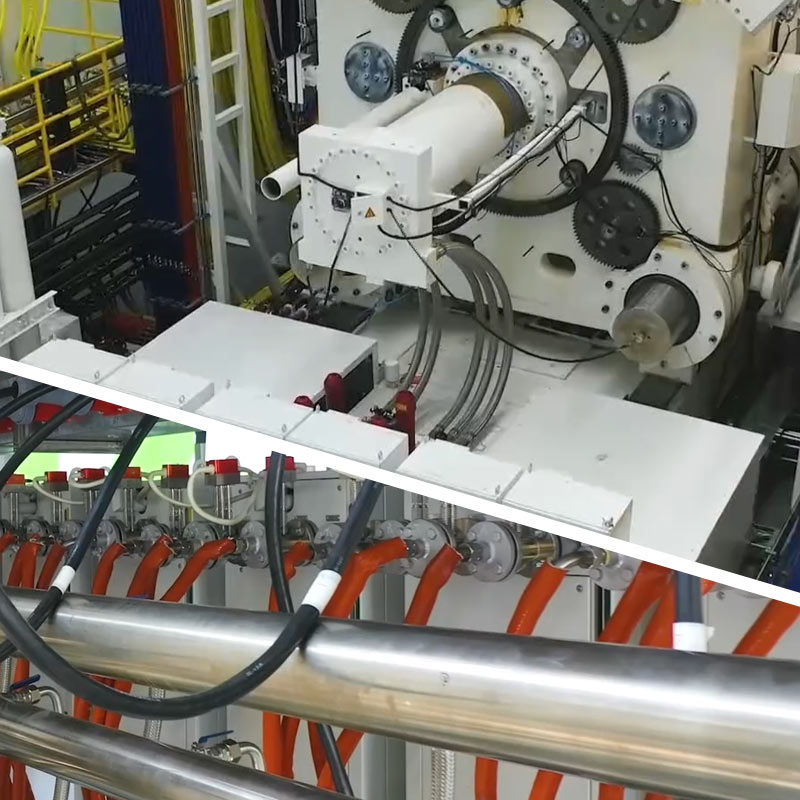

Since its inception in 1938, glass fiber has evolved into a new, independent industrial system, distinct from traditional glass manufacturing. The history of the glass fiber industry reveals a pattern of cyclical development.

During World War II, the application of glass fiber and glass-reinforced plastic in war facilities, such as shrapnel-resistant drums and radomes, accelerated research and development in this field. In 1958, the introduction of the tank furnace drawing method significantly boosted production. From 1987 to 1989, a global shortage of fiberglass led to a surge in production. However, with the economic downturn in Western countries, global glass fiber production declined consecutively for two years from 1990 to 1991. Following the global economic recovery, the glass fiber industry began to rebound in 1994 and experienced substantial growth for four consecutive years. From 1997 to 1999, the Southeast Asian financial crisis slowed the development of the global glass fiber industry. Despite the downturn in the IT industry and the impact of the September 11 attacks in the United States, global glass fiber production maintained a high growth rate of 8.1% compound annually. Following the economic crisis in 2008, the glass fiber industry faced challenges, with major companies experiencing inventory backlogs and a number of production lines being affected. In 2010, with the momentum of economic recovery, the glass fiber industry is expected to experience sustained high growth.

Unlike cement, glass, and other traditional building materials, glass fiber production has not shown sharp declines during economic downturns. On the contrary, it can quickly recover from crises. Notably, after each adjustment period, glass fiber production and demand surpass previous peaks, demonstrating significant growth. Overall, glass fiber, as an excellent composite functional material with wide applications, continues to exhibit strong growth potential in the glass fiber industry, which remains a vibrant and promising sunrise industry.

Three, the focus of glass fiber production has shifted to China.

The initial investment in glass fiber production and the construction of large pool kilns is significant, with a long payback period. This has prevented a large number of small and medium-sized enterprises from entering the industry, leading to a rapid increase in industry concentration. On the one hand, glass fiber enterprises, represented by the Stone Group, continue to build new production lines and expand capacity. On the other hand, the acquisition and merger of enterprises are accelerating market integration.

In recent years, large glass fiber enterprises have continuously adjusted their structures through acquisitions and mergers and acquisitions to adapt to the new pattern of the international glass industry. By the end of 2007, the establishment of the OCV company, which was formed by the world’s top two manufacturers of glass fiber and composite materials, has significantly changed the competition pattern of the entire industry. Currently, the global glass fiber manufacturers mainly include the Stone Group, OCV, Chongqing International, PPG, JM, Taishan Glass Fiber, and others. Among them, the three largest domestic enterprises account for 70% of national output and approximately 35% of global production. The world’s top five enterprises account for 65% of the total output. Therefore, oligopoly competition in the global glass fiber industry is becoming increasingly fierce.

In this context, the regional pattern of glass fiber production has changed significantly. For a long time, the centers of glass fiber production were in Europe and the United States. However, in recent years, with the global industrial transfer, China’s glass fiber production capacity has continued to improve. In 2007, China’s glass fiber production surpassed the United States for the first time, becoming the world’s largest producer of glass fiber.

Four, domestic glass fiber industry ushers in favorable policies.

The State Council has approved in principle the “Decision” of the State Council on Accelerating the Cultivation and Development of Strategic Emerging Industries, determining the direction, main tasks, and support policies for the development of seven strategic emerging industries, including energy conservation and environmental protection, new-generation information technology, biotechnology, high-end equipment manufacturing, new energy, new materials, and new-energy vehicles. Among them, according to the current definition and classification of new materials by the Chinese Society of New Materials, new materials include metal-based new materials (titanium, aluminum, magnesium, and rare earth permanent magnet materials), new inorganic non-metallic materials (ceramics and glass), and polymers and composites (including three types of resin composites: glass fiber, carbon fiber, and polymer composites). It is evident that glass fiber, as a new material, will become the focus of support by the Chinese government, and the industry will continue to steadily rise

Here is the revised text with corrected grammar and punctuation:

Five, the alternative is very strong, with continuous development in application.

Fiberglass products, with their excellent performance and wide range of uses, have become essential raw materials in fields such as construction, transportation, electronics, electrical engineering, chemicals, metallurgy, sports, environmental protection, and military defense. Approximately 70% to 75% of fiberglass is used for the preparation of reinforced thermosetting and thermoplastic plastics, which are widely applied in various industrial equipment and building materials (such as the production of glass-reinforced plastic cooling towers, pressure pipes, water tanks, storage tanks, and corrosion-resistant equipment). These products are extensively used in the petrochemical industry, infrastructure construction, and the automotive industry. The remaining 25% to 30% is widely used in the manufacture of printed circuit boards, wind turbine blades, and filter nets, and is prevalent in the fields of electronics and electrical engineering, environmental protection, and new energy.

Glass fiber, as a superior performance material with a wide range of alternatives, is applicable in the national economy, national defense, and military fields. Currently, the consumption of glass fiber in developed countries is very high; the per capita annual consumption in the United States and Japan has reached 4.5 kilograms, while in China, it is only 0.6 kg. However, domestic demand is very impressive. In the automotive field, for example, China’s automotive industry has not yet universally adopted glass fiber (mainly concentrated in truck production), while foreign goods vehicles and trucks have been using it extensively. The application of glass fiber in automobile shells, instrument panels, base frames, and other components will greatly promote the use of glass fiber in China.

Six, the global construction of wind power promotes the strong development of glass fiber.

Wind energy is the fastest-growing energy technology in the world. The development and utilization of wind power in many countries have garnered significant attention. Currently, various types of glass fiber blades for wind power development have been developed and applied, such as those produced by US companies like JM and StarStran. In recent years, China and the United States have invested rapidly in wind power development, with new wind power installed capacity accounting for more than 50% of the global total. The U.S. Department of Energy plans to meet 20% of electricity demand with wind power by 2030. To achieve this goal, it is necessary to add 300 million kilowatts of wind power installed capacity, including 54 million kilowatts of offshore wind power. The EU has proposed to achieve a 20% proportion of renewable energy by 2020, with offshore wind power installed capacity reaching 40 million kilowatts in 2020. Therefore, the offshore wind power installed capacity must increase at an annual rate of 28%, from 366 MW in 2008 to 6900 MW in 2020. Consequently, the world’s wind power capacity is expected to grow at a rate of 20%, with new wind power installed capacity reaching 380,000 MW in 2010. Wind power has become the fastest-growing area of glass fiber application.

Currently, most new wind turbines are over 1.5 MW, with blade sizes ranging from 37 to 65 meters. Glass fiber is an important raw material, with an average of 3.5 tons of fiberglass yarn per blade. Each 1 million kilowatts of installed capacity requires 10,000 tons of glass fiber, accounting for more than 25% of the total cost of the blade. In 2008, China’s wind power supporting blades, engine room covers, and head covers, along with a series of glass fiber-reinforced plastic composite products, reached 50,000 tons. In the next few years, China’s wind power market will continue to expand rapidly. It is expected that in 2011, the new wind power installed capacity will be 11.5 million kilowatts and 15 million kilowatts in 2020, driving up the glass fiber usage to 112,000 tons and 146,000 tons, respectively. Currently, Taishan Fiberglass Technology and Chongqing Polycomp International Corporation have a higher market share in the domestic wind power field. The rapid development of global wind power construction will bring the most powerful driving force for the development of glass fiber.